When you build and sell a property, calculating the profitability is relatively simple – if your revenue from the sale is more than your costs, you’re probably doing OK.

But how can you accurately account for profitability if there’s no final sale, such as if your development is a build-to-rent project? And how can you demonstrate this to lenders and investors?

In this situation, many developers will use IRR.

What is IRR and how does it work?

IRR stands for Internal Rate of Return. It gives an indication on the return you get from an investment and helps you to compare different projects.

Some types of lenders (such as debt lenders and equity investors) use IRR to determine whether projects they are offered meet their investment criteria (often referred to as ‘hurdle return rate’). As a developer, in those instances, knowing your expected IRR can be helpful.

But even if you don’t need to impress lenders, IRR may be a helpful way to assess the returns on your own investment, especially when you have multiple opportunities to choose between.

First, it starts with the net present value (NPV). This is a way of determining how much a future pound is worth invested versus if you kept it in your pocket today.

If you lend someone £100 today and they pay you back £100 in two years, you’ve actually lost money. That’s because £1 now is worth more than in two years, for two reasons:

- Inflation – the value of money goes down over time (just ask your parents how much their first job paid them compared to yours).

- Missed opportunity – money you have now can be invested, and generate a return in those two years. For instance, assuming a 5% return that £100 now would be worth £110.25 in two years.

This changing value and opportunity cost is what IRR attempts to address.

IRR discounts all of your inflows (e.g. rental income) and outflows (e.g. investments) of the cashflow back to an equal present value (i.e. what they are currently worth).

The result is that you can compare different projects more accurately – apples can be compared with apples.

Seeing IRR in action

The abstract can be slightly confusing, so let’s look at a real-world example.

You have £1m to invest today, and two projects to choose from:

- Project One – has a return of £600k after 6 months and a further £600k after 12 months (£1.2m, or £200,000 profit).

- Project Two – has a return of £295k every 3 months up until 12 months (£1.18m, or £180,000 profit).

At first glance, Project One is the better return at 12 months. But IRR shows us it’s not that simple…

The payments break down like this:

- Table 1 – Example Cashflows

|

Dates |

Example One |

Example Two |

|

01/01 |

-£1,000,000 |

-£1,000,000 |

|

01/02 |

||

|

01/03 |

£295,000 |

|

|

01/04 |

||

|

01/05 |

||

|

01/06 |

£600,000 |

£295,000 |

|

01/07 |

||

|

01/08 |

||

|

01/09 |

£295,000 |

|

|

01/10 |

||

|

01/11 |

||

|

01/12 |

£600,000 |

£295,000 |

- Table 2 – Key Deal Metrics

|

Measures |

Project One |

Project Two |

|

Investment |

£1,000,000 |

£1,000,000 |

|

Duration |

1 Year |

1 Year |

|

Profit |

£200,000 |

£180,000 |

|

Profit on Cost |

20% |

18% |

|

IRR |

32% |

36.9% |

On a pure profit-on-cost basis, Project One is clearly the better option as it produces £200k of profit whilst Project Two only produces £180k.

But because IRR considers the time the investment funds are out the door (referred to as the ‘time cost’ of money) it rates the second example as better.

Essentially, when you get the first £295,000 payment, you can put it to use for three months while Project One still keeps all your money tied up (then the same at nine months).

In short, the higher the IRR, the better return the project represents.

There are different types of IRR. Depending on what you consider the investment (the cost you bought/built the property for), the two main types are:

- Ungeared or Project IRR – considers the investment to be developer equity and money borrowed from any funding partner.

- Geared or Equity IRR – doesn’t include investments covered by the funding partner but takes into account the repayment to the loan – it is calculated entirely from the perspective of the developer.

So it really boils down to which you need it for, and which will be most useful for you.

Want to calculate IRR for your own projects?

We tend to think of money as having a fixed value, so getting your head around IRR can take a little while if you’re new to the idea.

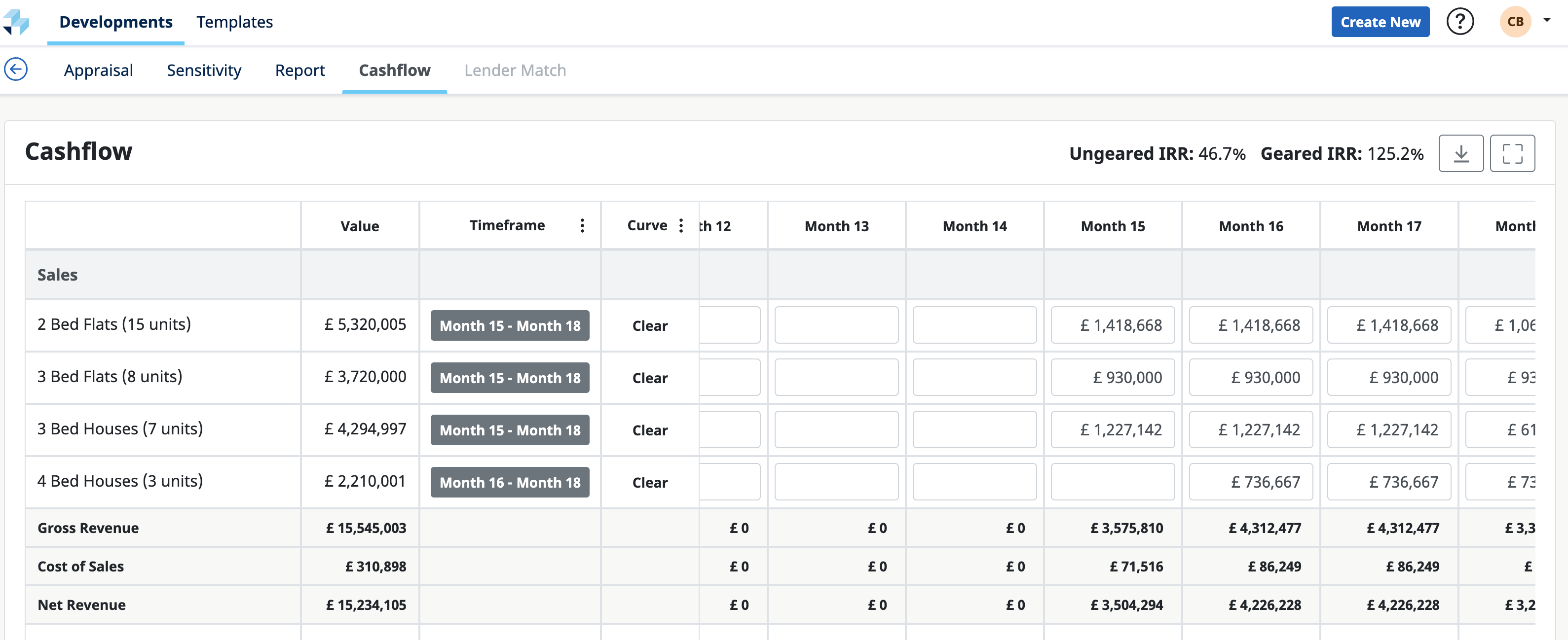

Luckily, we’ve recently incorporated IRR into LandFund, our free development appraisal tool.

That means you can see the IRR at the top of the cashflow, automatically calculated from the inputs you gave.

That makes it faster to choose between multiple opportunities for you, and easier to give that figure straight to investors.